Award-winning PDF software

Sba 1919 and Sba 1920 Form: What You Should Know

Sep 12, 2024 — SBA Form 1920 is used to complete the borrower agreement. When is the loan due? Are my payments due? What is the balance of the loan? (What am I expected to do with the money? What will it accomplish?) Note: The first few questions are self-explanatory. Question #1, #2, and # 3 can be answered by the borrower in the form. There are no answer options after question #4. Question #1: If you do NOT have any previous outstanding loans, how much money can I borrow? The default answer is 0. What does this say to the borrower? It would be informative for a borrower to determine if there are other outstanding student loans or other undue financial burdens that need to be dealt with (for instance, car payment, health care, etc). Question #2: How much will I contribute to the loan? (The borrower can answer this question) LTV-3 or LTV-1 -- This is what you have to know. As the borrower, there are only two ways to answer this question: the whole amount will be disbursed immediately (3 or 1) or only a portion of the required amounts will be disbursed (1) Question #3: How much interest will I pay on the loan? For the purpose of this question, all loan benefits include interest. (As with all loans here, you don't have to tell SBA what interest rate you will pay. You may choose to pay an interest-only loan.) The interest rate was calculated as follows: the loan principal + a 3 to 1 return, minus the original loan amount plus a 1.25% fee (based on an investment return of 3.25 percent). Question #4: What are the loan term and monthly payments? LTV-3 — For a 2.5 percent monthly payment that was calculated from the SBA loan application. The repayment would be a 0 monthly payment. The payment amounts will be added to the loan if there is no other outstanding debt. LTV-1 — The loan was a 1.75 percent, interest-only loan (plus the 1.25 percent fee).

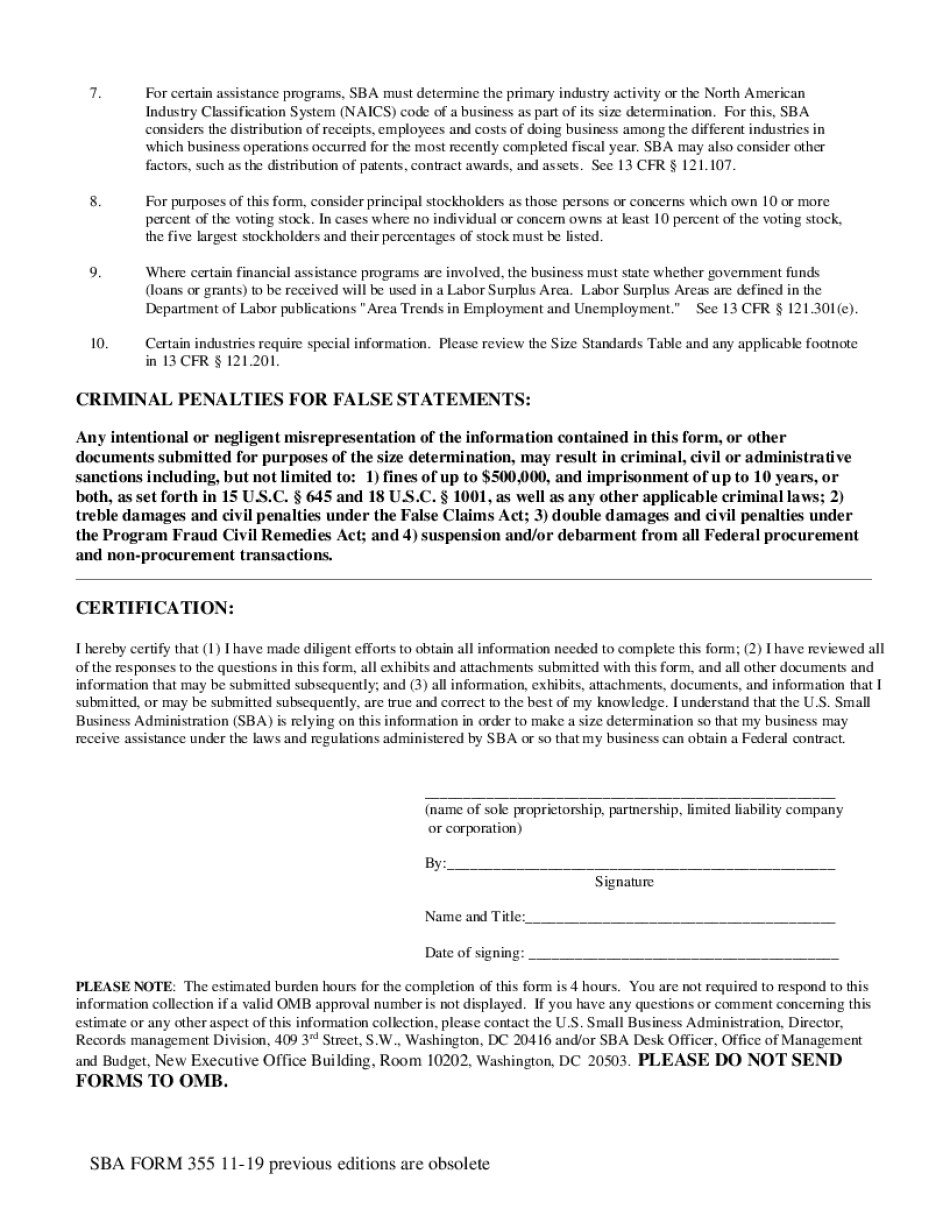

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 355, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 355 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 355 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 355 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.