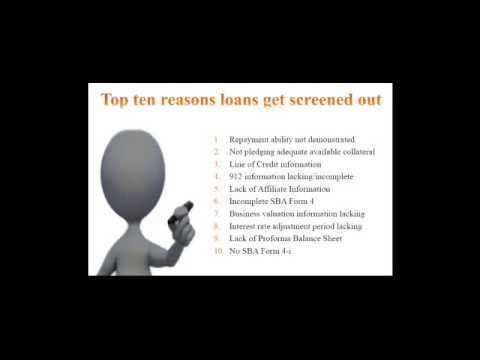

The top 10 reasons loans get screened out: repayment ability is not demonstrated. This is where I'll refer you back to the credit memo. The lender's credit memo and your materials/guarantee the debt service is not demonstrated and therefore you will have to be screened out. It will encompass a question about repayment ability. Either you didn't provide financials, or the financials that you provided didn't justify the repayment ability. You also didn't provide projections or elaborate on them to get a ratio that our analysis regards as important. On the second page of the lender form, it instructs the lender to complete the necessary five requirements that the SBA would like commented on. Out of the lender, you know you're not only covering the five Cs but you're also covering what the SBA's requests are as far as balance sheet ratio analysis and your analysis of repayment ability since they state that it's something they need to see demonstrated in order to approve the loan. Juna, do you know what percentage of the deals are screened out? Do you know the other stats? I would say that quite a few, probably all of them. I don't think there's a general rule. There's probably such a thing as a great deal, but I don't think there's such a thing as a perfect deal. So, I feel like if everyone is doing their due diligence, there would be, at some point, some sort of question. The SBA doesn't always have to send a screen out. They may contact the lender or packager directly, Bob, with maybe, you know, you didn't fill in so-and-so's full name or you didn't check this. There are some screen apps or there are some questions or some actions that can be taken without sending a formal...

Award-winning PDF software

Sba 4 Form: What You Should Know

USCIS) for an DACA Application or Form (DS-260) Dec 5, 2024 — This form is a supplemental USCIS “frequently asked questions” document that the applicant has to fill out. A comprehensive list of USCIS biographical information questions may be found here — USCIS Biographical Questions Form If you're applying for DACA and using the SSA service, we recommend you answer these questions on this form in order to obtain the following information: Note, while we're listing questions that are included by U.S. Citizenship and Immigration Services (USCIS) and not USCIS, the list below must be filled out entirely by the “diversity consideration applicant” (discussed below). If you leave some “unanswered” questions, you will not receive this additional information. The Diversity of Consideration Applicant (DCA) Form — SF-180 Aug 28, 2022— USCIS will require a completed Diversity Evaluation and Action Request form (DRA/RER) in order to provide information on: the applicant's citizenship or lawful permanent residence status, citizenship status, prior criminal convictions, and the applicant's relationship to a beneficiary of the Deferred Action Program under the Deferred Action for Childhood Arrivals (DACA) program If you're using Secure Communities to pick up an application, you may provide a copy of the DRA/RER to the officer at the front counter in order to request additional documents. Aug 28, 2024 — U.S. Citizenship and Immigration Services will require a completed DACA Electronic Status Application (ESSAY) in order to verify the status of the DACA application and the applicant's lawful presence in the U.S.; or U.S. Citizenship and Immigration Services will require a completed DACA Electronic Status Application (ESSAY) in order to verify the status of the DACA application and the applicant's lawful presence in the U.S. U.S. Citizenship and Immigration Services will request all information on the DACA application or request additional information by email at DREAMerRecordsuscis.gov. Aug 28, 2024 — Before the Diversity Enrollment Advisory Committee (DEC AAC), USCIS will require a completed Enrollment Application (DA Form I-765) from each DACA beneficiary applicant to enroll and be considered for an appointment. USCIS will conduct a thorough examination for any missing information.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 355, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 355 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 355 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 355 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba form 4