Have you been contacted by a financing broker who is able to charge fees but is making certain proclamations of their abilities with your eidl alone? We're going to give you a tip at the end of this on how we know this and why you should know this too. Stay tuned for the end. Welcome to Advancing with Financing. I'm Linda Ray. I'm Trevor. - It sounds complicated. It's not. It's easy. That's why we break these down into small little parts and we want to make it easy for you. - The SBA process is complicated enough. Watch the video. - Many financing brokers are contacting small business owners about their eidl applications and here's why: they promise guaranteed results and larger loan amounts than you could even imagine are possible. - What? No? Where do I sign up? Wow, this sounds amazing! - Don't fall for it. Don't do it. Hang up the phone. Bye bye. - First of all, buyer beware. No broker on Earth, planet Earth, can guarantee a loan approval - not with the SBA, not with a lending institution, not with a bank, not with your great aunt tilly. No broker can guarantee a result, and tilly gets a lot of action. I like using the fragmentally a lot. I don't actually have an aunt tilly. - Buyer beware numero dos: No broker anywhere has direct access to the SBA, not even Congress. We've heard about that scenario, haven't we? Tune in to our previous YouTube video. We did a live stream event with our friend Lisa, who is a single mom solopreneur and went through hell with the SBA. She got her Congress person involved, and while the Congressperson's office did speak to the SBA, they didn't really get the result which...

Award-winning PDF software

Sba 159 Form: What You Should Know

The Complete SBA Form 159 (and SBA Form 505) — National Education Loan Marketing Association Feb 28, 2024 — The Complete SBA Form 159 (and SBA Form 505) is available now. It is also called The SBA Form 159 (and SBA Form 505)” It's The Complete SBA Form 159 (and SBA Form 505) — National Education Loan Marketing Association Oct 21, 2024 — The Complete SBA Form 159 (and SBA Form 505) is available now. It is also called The SBA Form 159 (and SBA Form 505)” It's The Complete SBA Form 159 (and SBA Form 505)”, which is the official The Complete SBA Form 159 (and SBA Form 505) — National Education Loan Marketing Association Dec 13, 2024 — All the information about the SBA Form 159 (and SBA Form 505) is included on the following pages, courtesy of the National Education Loan Marketing Association. Download .pdf. SBA Form 159: What It Is, and Why It Matters — NAGEL Apr 27, 2024 — SBA Form 159: What It Is, and Why It Matters. This form is an “SBA” form. It can be used for any SBA program or SBA program for which an SBA form was previously released. The SBA 159: What It Is, and Why It Matters — National Education Loan Marketing Association May 21, 2024 — This document will be updated. No other changes. No further SBA 158 (if applicable). What is this form? If you are getting a large federal loan for your small business, your lender probably might charge an SBA Form 159. That's where it all starts! What's the purpose of this form? To make sure your small business has access to all the money it needs to grow. You do your own due diligence, so you need to know where your business stands. This kind of loan is designed to fund a business that expands, or a larger enterprise to grow the number of people working in an existing business. All applicants must fill out this form, which is used to document your business's finances (including revenue and expenses). Any small business should do this. It helps the government understand who you are before you take the loan and who your partners are. What is an SBA 159? The SBA 159:Whatitisincsba.

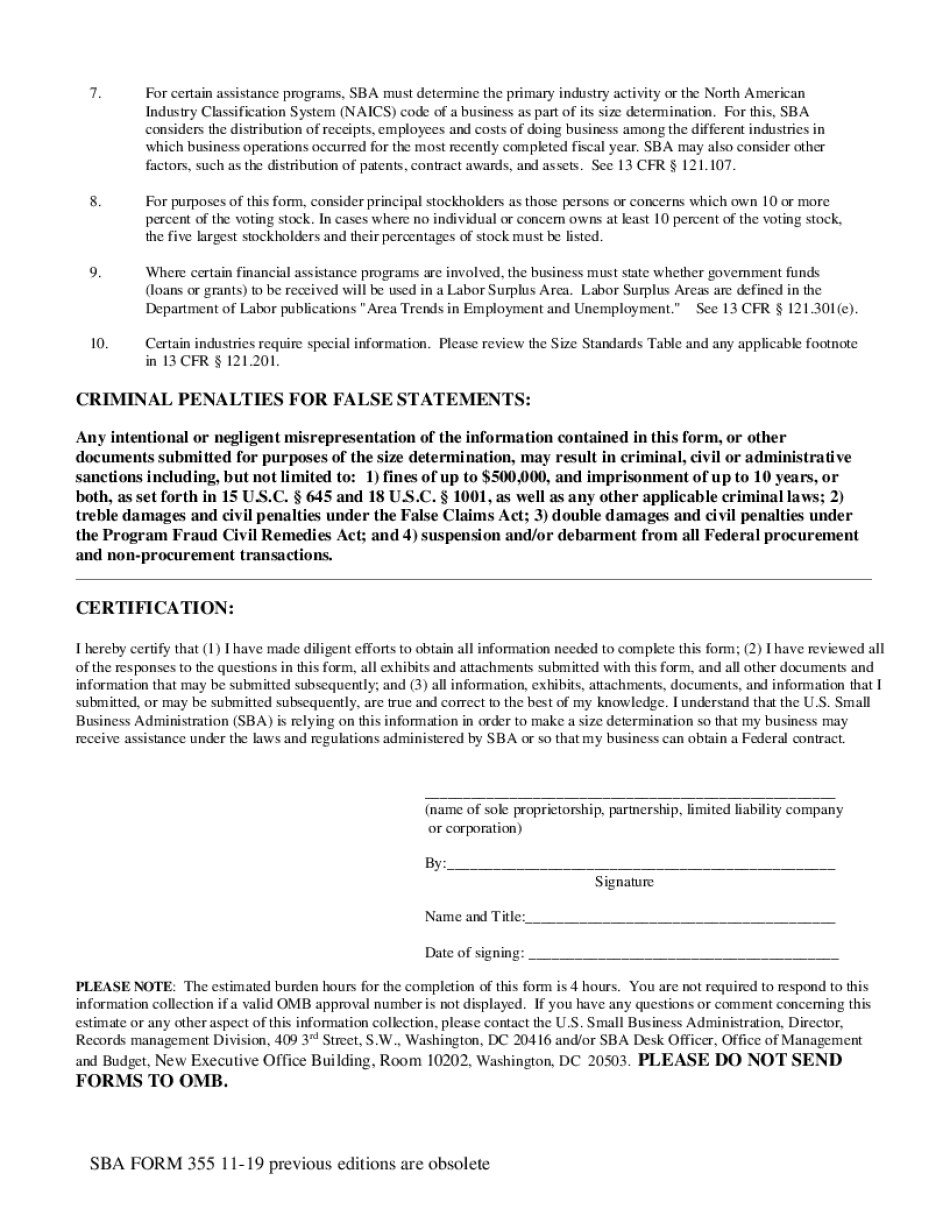

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 355, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 355 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 355 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 355 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba form 159