It's the major hurdle every new entrepreneur faces, time and time again: raising money. You've got a great business idea, but how the heck do you get it off the ground? Hi there, I'm David Waring, and I'm the co-founder of FinSmallBusiness.com. In this video, I'm going to show you nine ways to fund your startup. By the end of the video, you'll know which option suits your needs and how to increase your chances of getting funding, so stick around. Startup financing option number one: get an SBA startup loan. Traditional bank loans and SBA loans are generally the most difficult and slowest way to get money for your business. To get an SBA loan for your startup, you will generally need a high net worth, real estate with equity that can be used as collateral for the loan, an airtight business plan, and a credit score above 700. If you meet all these qualifications, congratulations! That's difficult to achieve. You're likely a good fit for the Small Business Administration's Community Advantage program and microloan program. The SBA's Community Advantage program lets your startup borrow up to $250,000, and the microloan program provides smaller loans of up to $50,000. Entrepreneurs who qualify for these programs have invested at least 30% of their own money in the business and have relevant management and industry experience. Startup financing option number two: Rollovers for Business Startups (ROBS). The best-kept secret for funding a business is a ROBS. ROBS allows you to invest funds from your retirement account into your new business without paying early withdrawal penalties or income taxes. Essentially, you are buying stock in your company with funds from your 401(k) and holding that stock inside your retirement account. ROBS are best for people who have at least $50,000 in their retirement account....

Award-winning PDF software

Sba 1919 revised 5 17 Form: What You Should Know

Who is my business' principal? When is my business' primary operating period? What is the maximum loan amount that can be financed? What are the requirements for applying for an SBA 7(a) Loan? How do I apply for an SBA 7(a) Loan? What is SBA Borrower Information Form? Who is a Small Business Loaned? Who do I contact if I want SBA information? What SBA forms are not used for SBA 7(a) loan applications? How does the SBA make a loan to a Small Business? If I do not repay my SBA 7(a) Loan before the loan's maturity date, will I be charged interest on that balance? How does the SBA determine my loan amount, loan term, and SBA loan repayment period? Are there any SBA rules that change by using the SBA 7(a) Loan? SBA 7(a) Loan Information What is a Small Business Loan? What is SBA Loan Processing Period? How long does it take to approve an SBA 7(a) Loan? What do I need to do to start an SBA 7(a) Loan? What do I do if I don't have enough money to start my SBA 7(a) Loan? Do I still need to start my SBA 7(a) Loan if a co-borrower is in default on the loan? What is the SBA's maximum lending limit for SBA 7(a) Loans? When do I have to send SBA a notice of deficiency? How do I send the SBA a notice of deficiency? Who do I contact if an SBA loan is denied? What is the loan closing process? What has the federal government done to support the SBA? What has the SBA done to support the Federal Government? Can an SBA 7(a) Loan be used by a domestic business? Will the SBA use SBA 7(a) Loans to support other SBA programs? SBA 7(a) Loan Processing Periods When do I need to send SBA a notice of deficiency? How do I get an SBA 7(a) Loan? Is the SBA a government agency? What is an SBA 7(a) Loan? What has the government done to support the SBA? Who is a Small Business Loaned? What do I contact if I want.

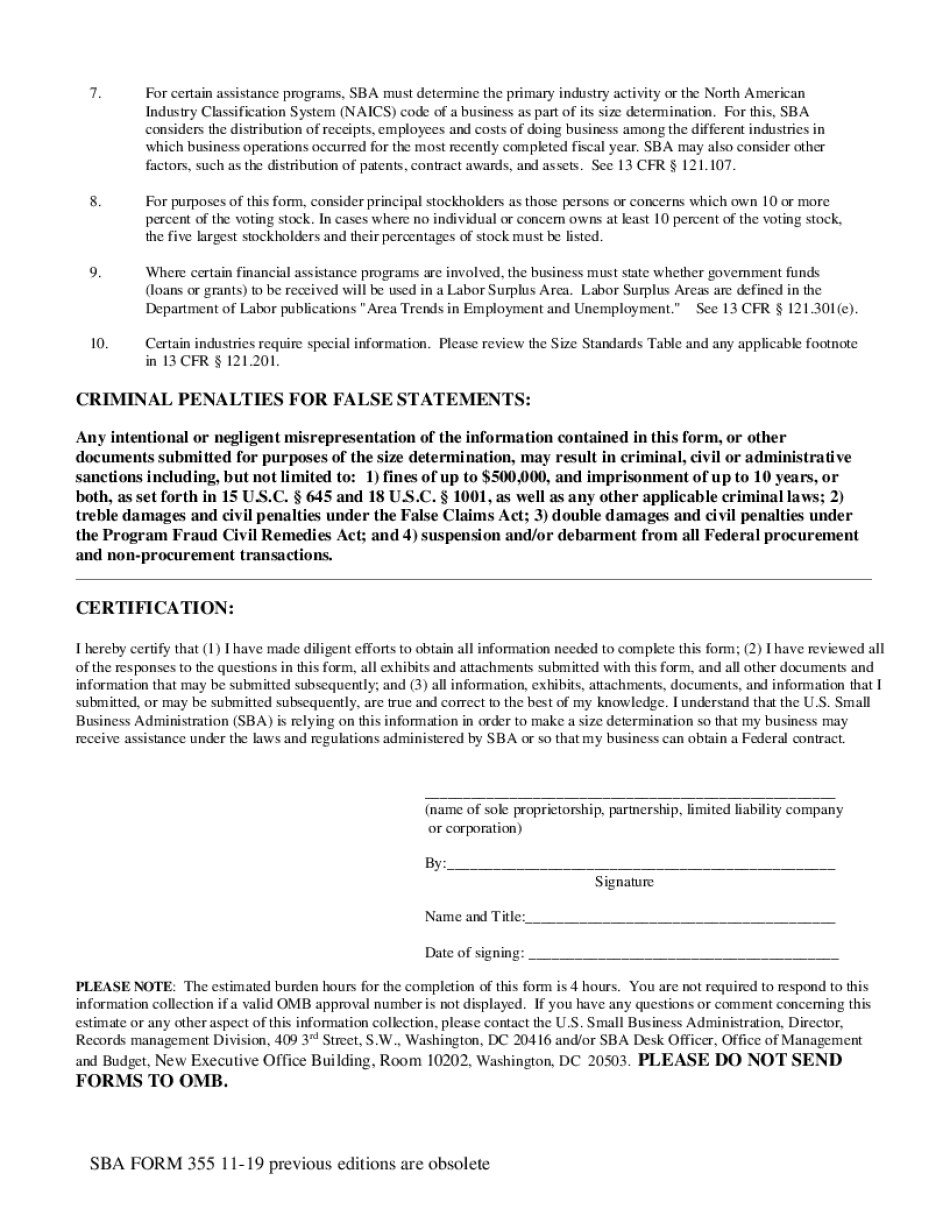

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 355, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 355 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 355 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 355 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba form 1919 revised 5 17