At Lend Genius, our mission is to demystify the world of business lending and make financing more accessible to small business owners like you. No matter what business you're in, by the end of this video, you'll have a full understanding of SBA loans – what they are, why they're important, and most importantly, how to get one. The Small Business Administration (SBA) is a government body that supports entrepreneurship in America. It backs third-party loans for growth activities such as purchasing inventory or equipment, buying real estate, and acquiring other businesses. With rates as low as six percent and terms as long as twenty-five years, SBA loans are among the most inexpensive forms of financing available to small business owners. They are applicable for many general business needs. The general SBA 7(a) loan program is a broad and well-known category that provides flexible loan guarantees of up to five million dollars. There are also real estate and equipment loans available through the CDC 504 loan program, which helps business owners obtain property and other tangible assets with a favorable low downpayment, fixed interest rates, and long repayment periods. Additionally, there's the microloan program, which is perfect for businesses seeking a loan of $50,000 or less to be used towards machinery, furniture, inventory, or supplies. Let's not forget about the disaster loan program, which provides low-interest loans to replace or repair property, machinery, equipment, or inventory damaged in a disaster. But how do you qualify for an SBA loan? The first thing you'll have to do is complete an SBA loan application. Eventually, you'll also be asked to produce financial documents, tax returns, legal documentation, and a business plan. The requirements may vary depending on which program you're applying for, but not all SBA lenders require this much documentation. You'll have a great...

Award-winning PDF software

Sba 480 Form: What You Should Know

See 1405A Notice for SIC Exam Nomenclature Guide. SBA Form 480 Size Status Declaration A SIC has reported more than 60 days of time loss in all three of the SIC areas: small business; small manufacturer; and small distributor. SBA Form 480 Size Status Declaration To determine whether a SIC is a small business (SBA 3) or small manufacturer (SBA 3), it must have received the information on SBA Form 480 SBA Form 480 Size Status Declaration. It must also report whether any one of the SIC areas has required more than 60 days of time loss. See SBA Guide 1520: Small Business Examination. Supporting Statement for SBA Form 480 — SIC Exam Form This supporting statement (Form SBA Form 480) states that the applicant is a small business, or small manufacturer.

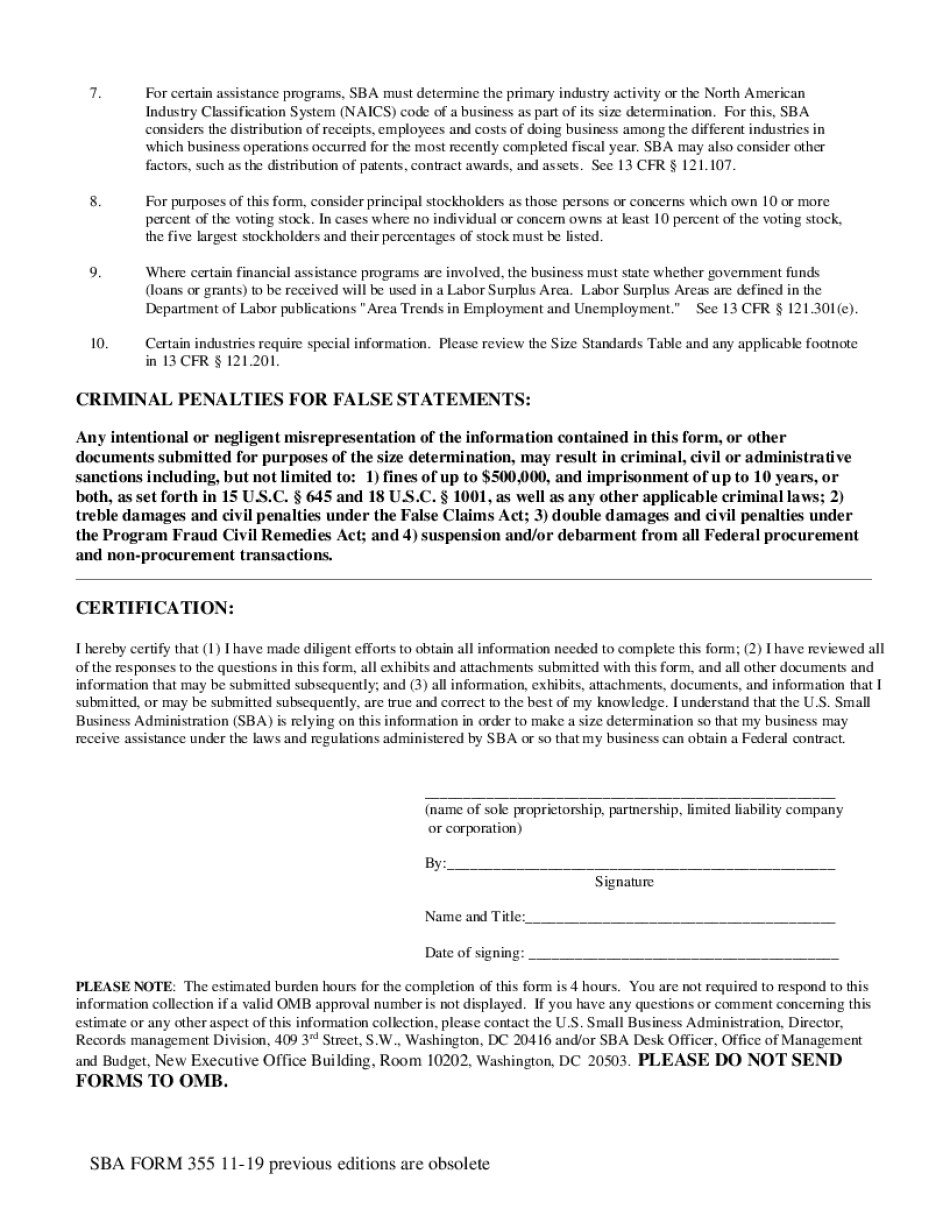

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 355, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 355 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 355 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 355 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba form 480