You are about to experience an awesome Small Business Administration loan complete guide. I imagine it will be really helpful for you in anything from considering needing funding for your business to successfully getting one of the best business loans available if you're in the United States of America, which is a Small Business Administration loan. I've heard from my loan adviser on Fund Era that you can get up to ten-year terms or standard ten-year terms of 8% interest. That means approximately a hundred thousand dollar loan would be about eight thousand dollars in interest and the payments might only be less than two thousand dollars a month for that. That's outstanding! That's a really good business loan, maybe even like fifteen hundred or less. I was just off the top of my head. Let's go in, what are we going to cover in this video? First, we're going to begin with a look at the basics. You might wonder, okay, who are you to be telling me this? I've had a business teaching online for seven and a half years. I've been going through the business funding process to scale my business up recently, and I've just gone through all this process researching a whole bunch of different loans, applying for an SBA loan, only to be told my cash flow was not adequate for it. Basically, if I had applied five months ago, then I would have been in good shape. So I've just done this myself as a business owner, which might be nice for you since there's no personal incentive in this for me to get you to use any of my stuff. This is just what I've learned, and I think it might be helpful for you. Here's what you want to know up...

Award-winning PDF software

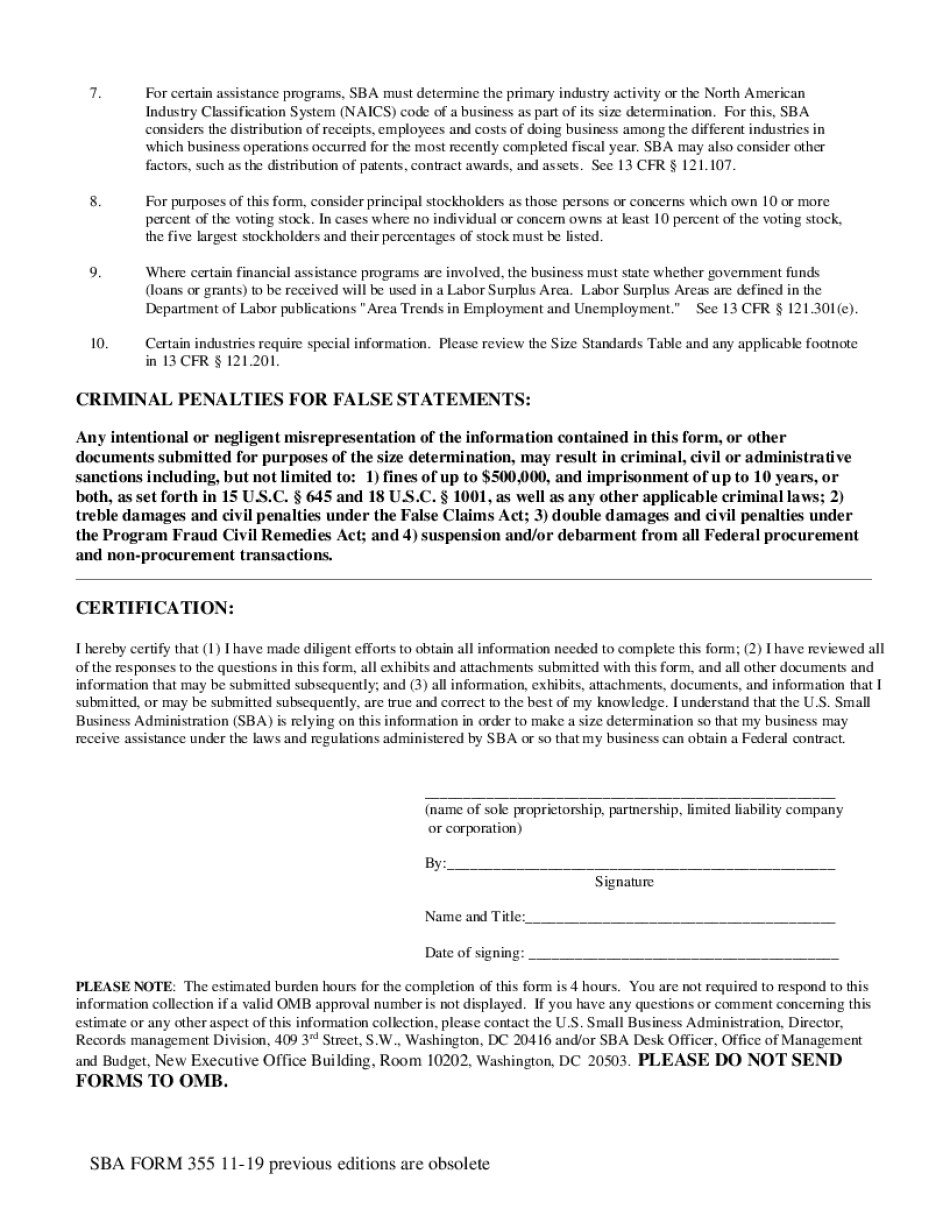

Sba 355 Form: What You Should Know

The purpose of SBA Form 355 is to help businesses comply with the SBA and the laws and regulations that relate to SBA's mission. The SBA defines a small business as one: · (1) which has gross annual gross revenue for the SBC or an equivalent classification in excess of 5 million. · (2) which does not have employees when it files its SBC application for review. · which has fewer than 100 employees when the SBC is approved or disapproved. The SBA uses this information in determining whether the business meets the definition of a small business, or is eligible to obtain the Small Business Services program (SBS). SBA Form 355 must be completed and submitted to SBA by the due date each year. The SBA uses this information in determining whether the business meets the definition of a small business, or is eligible to obtain the Small Business Services program (SBS). Do You Need to Comply with SBA Form 355? As we can see, the SBA has set a certain amount of information that the SBA must provide the customer in order to qualify their business as a small business. However, SBA Form 355 doesn't mean you have to comply with their information requests. You don't need to fill out the form if you are not eligible for the SBS. If you are not eligible for the SBS, then the SBA will tell you that you are not a small business, or they may request additional materials that you will need. The information required in SBA Form 355 (and which the SBS is for) is usually only required by state-based SBA advisory authorities that may make the decision regarding a small business's existence. The decision is made based on the company's history, the business's size, and the company's financial and physical characteristics if you are a small business applicant. What Information is Required on Form 355? The SBA requires that businesses send the SBA a number of documents, which they need to send separately. For more information about the documents that must be provided with an SBA Form 355, visit the SBA's Small Business Handbook for Form 355.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 355, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 355 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 355 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 355 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba Form 355